Pursuing a Better Investing Experience

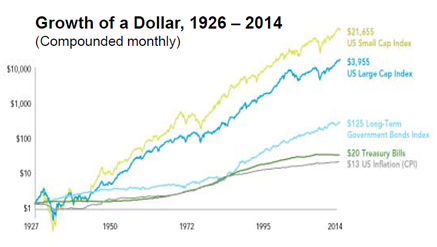

The U.S stock market has been an engine for wealth creation throughout the past century. This is especially true when investors are mindful of how markets work, what strategies deliver success, and what to ignore. So, how exactly do successful investors approach the markets? Below we highlight ten ways any investor can create a better investing

experience and generate consistent returns over time.

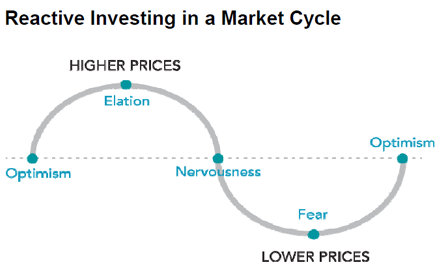

Successful investing takes time, discipline and patience.

Successful investing takes time, discipline and patience.