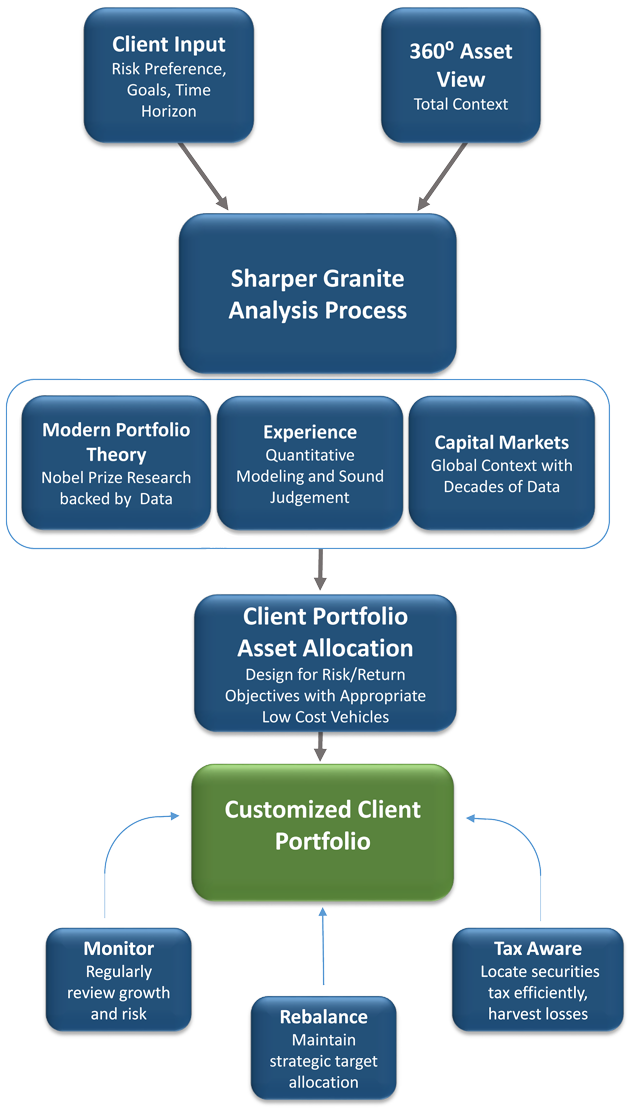

Comprehensive Investment Process

Our investment approach relies on a combination of Nobel Prize winning modern portfolio theory, empirical data, and sophisticated investment architecture. Each investment portfolio is constructed from a world of investable assets and tuned to each client’s individual risk preference for a tax efficient, low-cost, holistic and hassle-free investment experience. Taking a holistic view of the client's assets, including those beyond our management, allows us to build comprehensive strategies where all assets work together toward stated goals. This allows us to create a portfolio that is well suited for each individual investor. Portfolios are reviewed regularly and rebalanced as necessary.

By tuning a portfolio to individual risk tolerances, we alleviate some of the worry that naturally comes with market fluctuations and economic news cycles. By creating a comprehensive strategy and sticking to it, we can eliminate knee-jerk reactions that erode investment returns over time.